Hungry for new funding, Google-backed AI startup Mobvoi debuts in Hong Kong...

By Rebbeca Ren | 2024-04-24 14:31

【数据猿导读】 Abstract: Branding itself as Hong Kong's “first AIGC stock,” Mobvoi does has a leg up with its expertise in voice interaction and software-hardware integration. Yet, the journey ahead is a steep uphill battle....

Twelve years after its founding, the artificial intelligence company Mobvoi has achieved a long-coveted milestone by going public on the Hong Kong Stock Exchange (HKEX).

The Beijing-based firm, established by former Google researcher Li Zhifei, specializes in AI solutions and smart devices.

Mobvoi opened at HKD 2.98 per share, far below the IPO price range of HKD 3.7 to HKD 4.1, giving it a market cap of about HKD 4.6 billion.

According to the company, 44.3% of the proceeds will be used to enhance its flagship multi-modal large model "Sequence Monkey", while 35.7% will be used for new product development and market expansion over the next three years.

The AI upstart has raised around $75 million over five funding rounds from prominent backers including Sequoia China, ZhenFund, SIG, Perfect Optics, Goertek, Volkswagen and Google. Its last private valuation stood at $750 million.

In this IPO, two state-owned enterprises, Nanjing Economic Development Juzhi Technology Innovation Investment Partnership and ZGC Group, invested HKD 95 million as cornerstone investors.

As the first-ever AIGC (AI-generated content) company to hit HKEX, Mobvoi’s adventure is just getting started.

Started as a smart device company, but has grown stronger in AI

Mobvoi's core team comprises former Google employees, AI experts, ex-Nokia staff, and engineers and researchers from prestigious institutions such as Johns Hopkins, Harvard, MIT, Cambridge, and Tsinghua.

(Zhifei Li)

The company’s founder, Zhifei Li, is a notable tech industry figure known for his contributions to AI. His tenure as a researcher at Google provided him with deep insights into cutting-edge AI technologies, fueling his motivation to establish a company that could weave AI into the fabric of daily life.

After leaving Google, he established Mobvoi, a company dedicated to developing a range of products, including smartwatches, smart speakers, and earbuds, all powered by its proprietary AI technology.

According to the company’s prospectus filed with the HKEX, with data up to 2023, Mobvoi’s flagship TicWatch has proven successful. Featuring in-house voice-interaction technology, it has sold over 1 million units across more than 100 countries since 2020.

(TicWatch Pro 5)

In the fiercely competitive smart devices sector, dominated by giants such as Xiaomi, Baidu, and Huawei, Mobvoi faced escalating losses as it tried to scale up. In 2019, recognizing the unsustainable cost of expansion, Li took bold action, slashing the workforce from 1,000 to 500 to streamline operations and cut expenses.

Fortunately, the recent AI boom, spearheaded by innovations like OpenAI’s ChatGPT, has presented Mobvoi with a fresh opportunity. The company is now strategically pivoting to capitalize on this trend.

Thanks to Mobvoi’s years of efforts on human-machine voice interaction, it has amassed expertise in Natural Language Processing (NLP), giving it an edge in today’s AI space, where LLMs are leading the innovation.

NLP is pivotal for LLMs, which underpin generative AI products like ChatGPT, Gemini, and Claude, as it allows these systems to comprehend, process, and generate human language effectively.

As the company shifted its focus from devices to AI solutions, revenue from smart devices and other accessories fell from 85% of total revenue in 2021 to 32.3% in 2023.

Enterprise AI solutions, the biggest revenue driver

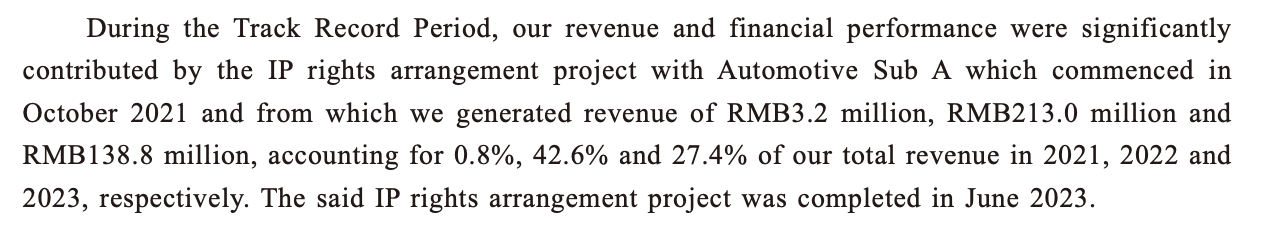

Mobvoi’s latest prospectus highlights a significant surge in revenue from AI solutions, escalating from RMB 59.519 million in 2021 to RMB 302.888 million in 2022, and reaching RMB 343.247 million in 2023. Accordingly, AI solutions’ share of total revenue has dramatically increased, jumping from 15% in 2021 to 60.6% in 2022, and further to 67.7% in 2023.

Driving Mobvoi’s growth is its focus on enterprise-oriented AI solutions, catering to a diverse range of sectors including automotive, finance, technology, media, telecommunications, healthcare, and retail.

Revenue from these enterprise AI solutions climbed from RMB 52.697 million in 2021, RMB 263.031 million in 2022, and then slightly declined to RMB 225.642 million in 2023.

The company attributed the year-over-year decline to lower revenue from intellectual property (IP) arrangements with “Automotive Subsidiary A”.

Although no company was explicitly named, analysts believe it is likely Volkswagen: the German automaker invested in Mobvoi in 2017 and formed a joint venture. This collaboration led to the integration of Mobvoi’s smart car systems into 20% of Volkswagen’s vehicles as of 2021.

The JV proved short-lived. In 2022, the duo reportedly executed an equity swap, whereby Mobvoi transferred its shares in their JV to Volkswagen and repurchased its own shares from the automaker. Consequently, the JV became a wholly-owned subsidiary of Volkswagen.

As part of the transaction, Mobvoi transferred some IP rights related to the in-vehicle voice dialogue system to Volkswagen. The prospectus shows that the IP agreement has brought considerable revenue to Mobvoi: RMB 3.2 million, RMB 213 million and RMB 138.8 million in 2021, 2022 and 2023 respectively, accounting for 0.8%, 42.6% and 27.4% of total revenue for the corresponding years.

Unwinding its deep ties to Volkswagen has both pros and cons for Mobvoi: While it led to a drop in revenue, it also opened up opportunities for Mobvoi to partner with other automakers. The company disclosed in its prospectus that it has established technical cooperation agreements with several top global and domestic automobile manufacturers.

Homegrown LLM “Sequence Monkey” powers consumer-facing AI solutions

Mobvoi’s consumer-facing services, referred to as AIGC solutions, have shown remarkable growth over the years. According to the company, these services generated RMB 6.822 million in 2021, RMB 39.857 million in 2022, and RMB 117.605 million in 2023.

The growth is also reflected in their increasing share of the company’s total revenue, rising from 1.7% in 2021, 8% in 2022, and reaching 23.2% in 2023.

The company’s AIGC offerings target content creators, providing a suite of specialized tools. These include “Moyin Workshop (魔音工坊)”, an AI dubbing assistant tailored for Chinese users, and “DupDub” for international markets. Additionally, the lineup features AI writing assistants such as “Mozhuan Writing (魔撰写作)” and “Qi Miao Wen (奇妙文)”, alongside the 3D AI digital character “Weta365 (奇妙元)”, etc.

As of 2023, the AIGC solution matrix has collectively amassed over 10 million cumulative registered users globally, according to the company.

The backbone of these solutions is “Xuliehouzi”, or “Sequence Monkey” in English, an in-house developed Large Language Model launched in 2023.

It has tens of billions of parameters, and for reference, OpenAI's GPT-3 has 175 billion parameters. Sequence Monkey has been integrated into a multi-modal framework capable of supporting diverse functions such as text generation, image creation, 3D content development, speech generation, and speech recognition.

Previously, Mobvoi’s AIGC products utilized various separate algorithm models, including UCLAI, created in 2021 to understand and generate text.

Sequence Monkey builds on UCLAI’s foundation but enhances its capabilities significantly, enabling support for multiple products. The introduction of Sequence Monkey has simplified R&D efforts and reduced cross-modal information loss by unifying the underlying technology across Mobvoi’s generative AI product line.

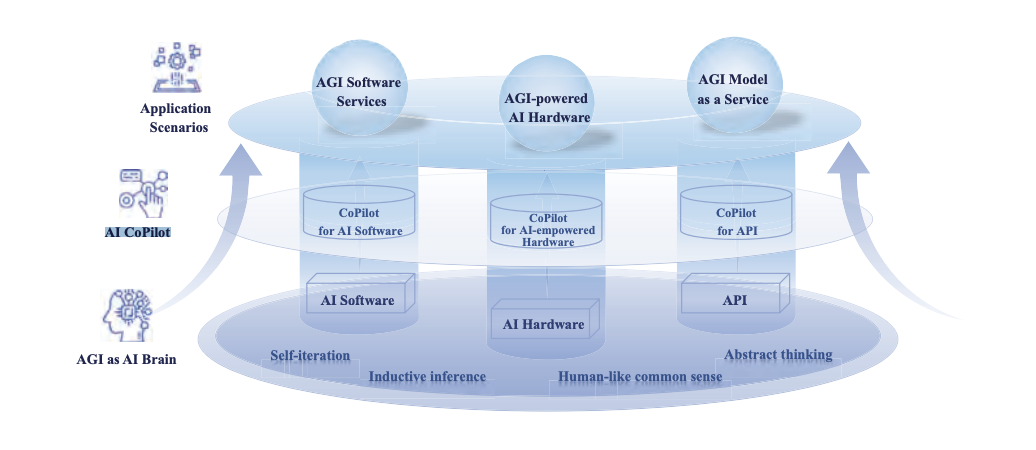

Drawing inspiration from Microsoft’s Copilot, which has been incorporated across all its productivity tools including email, Excel, PowerPoint, and Word, the company rolled out AI CoPilot, an AI assistant that integrates both software and hardware, powered by Sequence Monkey.

AI CoPilot sets itself apart by focusing on voice interaction and content generation technologies, features specifically tailored to meet the needs of global content creators, enterprises, and consumers.

The company identifies three major commercialization scenarios for Artificial General Intelligence (AGI), with AICopilot poised to play a crucial role in each:

1. AGI software services designed to bolster the capabilities of enterprises, professional content creators, and general users.

2. AGI-enhanced hardware that provides robust end-to-end connectivity, significantly improving the user experience.

3. AGI model services facilitate the creation of new revenue streams by providing application programming interfaces (APIs) that enable diverse applications.

Smart devices remain a practical approach for AI commercialization

As aforementioned, revenue from AI solutions has now outstripped that from smart devices. However, smart devices continue to serve as a fundamental avenue for AI commercialization—a pervasive challenge for pure AI companies.

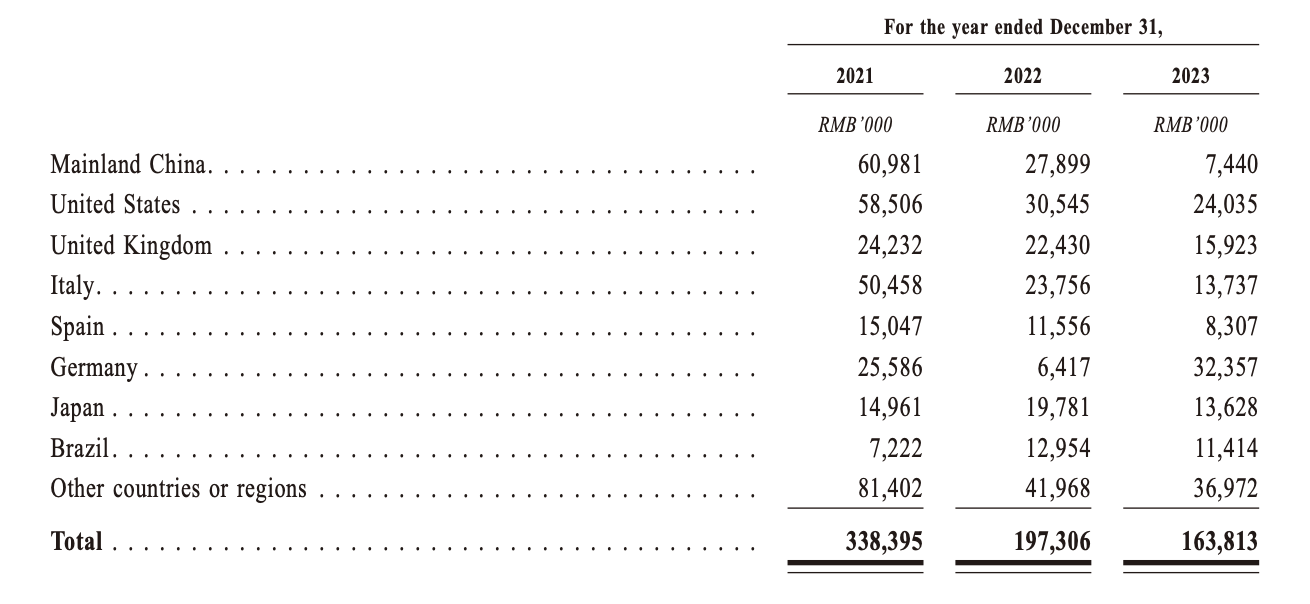

In 2021, 2022 and 2023, Mobvoi’s revenue from smart devices and other accessories was RMB 338.395 million, RMB 197.306 million and RMB 163.813 million respectively. These figures accounted for 85.0%, 39.4% and 32.3% of the company’s total revenue during the same period, respectively.

Smart devices and other accessories are performing well in overseas markets. Germany and the United States are the company’s two largest markets, with revenue in 2023 of RMB 32.357 million and RMB 24.035 million respectively.

Mobvoi’s competitive edge is rooted in its seamless integration of proprietary AI technologies with devices, a key strategy for AI commercialization. The lineup includes AI-enhanced smart devices such as the TicWatch series and the Mobvoi Home Treadmill Incline.

Looking forward, the company is committed to advancing its AI technology and continuing to incorporate it into its device lineup, ensuring ongoing innovation and appeal in its hardware offerings.

Intense competition in China and potential liquidity risks

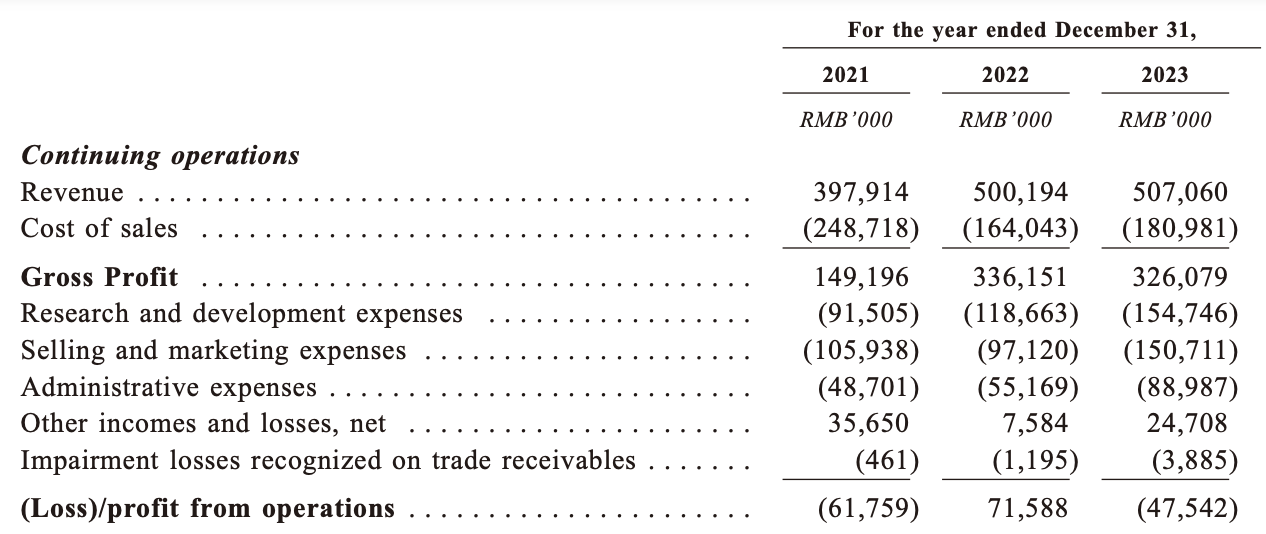

After grappling with operational losses of RMB 135 million in 2020 and RMB 61.759 million in 2021, Mobvoi briefly rebounded with an operating profit of RMB 71.588 million in 2022, only to slide back into a loss of RMB 47.542 million in 2023.

The prospectus reveals a significant uptick in R&D spending, rising from RMB 91.505 million in 2021 to RMB 118.663 million in 2022, with a further increase to RMB 154.746 in 2023.

The surge primarily stems from an expansion in the R&D workforce and escalating costs associated with the development of LLM. As of March 26, 2024, the R&D team comprises 55.0% of Mobvoi’s total workforce.

As of the end of 2023, Mobvoi’s financial statements reveal cash and cash equivalents of just RMB 144.324 million against a backdrop of RMB 4.517 billion in current liabilities, resulting in a net current liabilities of RMB 4.121 billion and signaling potential liquidity risks.

Without fresh investment for nearly five years, Mobvoi’s move to list on the HKEX is seen as critical for securing much-needed capital.

The company also outlines several risks affecting its future performance, including fierce competition in the rapidly evolving AI industry and the financial strain from ongoing investments in research and development.

In China, the race to develop LLMs resembles a modern gold rush, with over 100 models now vying for attention. Particularly, models developed by giants like Baidu, Alibaba, and Huawei are leading due to their substantial resources and technological prowess.

Baidu, for example, is extensively leveraging its LLM, Ernie, across various platforms, from enhancing its search engine capabilities to powering content creation. The technology is also integrated into Baidu’s smart devices and the models of its partner Great Wall Motors. Meanwhile, Alibaba is incorporating its LLM, Tongyi Qianwen, into its expansive cloud services, its e-commerce operations, and its line of smart speakers. Huawei is not far behind, embedding its own LLM, Pangu, into an array of products including smartphones and laptops.

Despite Mobvoi’s proficiency in the AI sector, competing with industry giants poses significant challenges.

Simply put, the term “large” in LLMs underscores two critical elements: the need for massive data and gigantic computing power—resources that necessitate considerable financial investment. These tech behemoths benefit from established ecosystems that seamlessly integrate their AI technologies, giving them a distinct advantage in development and deployment and making it difficult for smaller players to gain ground.

In addition, Mobvoi warned in its prospectus that geopolitical uncertainty, the complexity of China’s fluctuating regulatory environment and potential intellectual property disputes will also bring risks to the company’s operations.

The long-term success of Hong Kong’s first listed AIGC company will take time to test

According to data from China Insights Consultancy (CIC) cited in the prospectus, only two AI companies in China held a market share exceeding 5% in 2022, with Mobvoi capturing about 0.3% of the overall market.

But Mobvoi has carved out a niche in AI voice technology and NLP software solutions, where it holds a 1.4% market share and ranks third.

Further projections by CIC indicate that China's AI market is expected to expand to RMB 644.8 billion by 2027, maintaining a compound annual growth rate (CAGR) of 27.1% from 2022 to 2027.

This growth trajectory suggests substantial opportunities for Mobvoi to enhance its market position and expand its influence in the AI sector.

Branding itself as the “first AIGC stock” in Hong Kong, Mobvoi seeks to capitalize on the ongoing AI fervor, aiming for a significant valuation boost and the opportunity to seize pricing power in the market.

However, investors should temper expectations amidst the AI hype. Despite hefty investments in AGI, the technology still often struggles with hallucinations and has yet to revolutionize workflows.

The journey towards widespread AI adoption and achieving profitability is challenging, not just for Mobvoi but also for industry giants like OpenAI, Microsoft, and Google.

来源:DIYuan

刷新相关文章

我要评论

不容错过的资讯

大家都在搜